AJFH

AJFH is the investment arm of the Andrej Jovanović Family Office. It operates as a family-owned investment company investing in private equity and public markets.

About

AJFH (Andrej Jovanović Family Holding) is the investment arm of the Andrej Jovanović Family Office. It operates as a family-owned investment company investing primarily in private equity and public markets. Whilst maintaining a flexible approach, AJFH aims to invest in structurally growing acyclical companies with strong management teams.The Family Office has its roots in Marbo Product, a successful Southeast European snacks business that was co-founded by Mr Jovanović and which was sold to PepsiCo in 2008. Since then, a combination of successful investments in private equity (through Blue Sea Capital), direct private investments and co-investments, public markets, and real estate evolved into today’s family office structure.

Investments

ImlekLeading regional dairy producer processing almost 400 million litres of milk annually across its four plants. With a diverse product portfolio and strong consumer brands including the iconic „Moja Kravica“ („My Little Cow“), Imlek is recognised as a cornerstone of the regional dairy industry and one of the most trusted household names in the region.AJFH agreed to acquire Imlek as lead investor together with CEO Bojan Radun in November 2025.Company website

FAMARPharmaceutical contract development and manufacturing organisation (CDMO) with broad capabilities across multiple dosage forms including sterile, solids, semi-solids, and R&D services with six manufacturing sites located across southern Europe.AJFH co-invested alongside Mid Europa Partners in October 2024.Company website

Connectis TowerLeading independent telecom tower company managing a portfolio of over 1,800 primarily ground-based macro towers across Serbia, Bosnia & Herzegovina and Montenegro.AJFH co-invested alongside Actis / General Atlantic in January 2024.Company website

Team

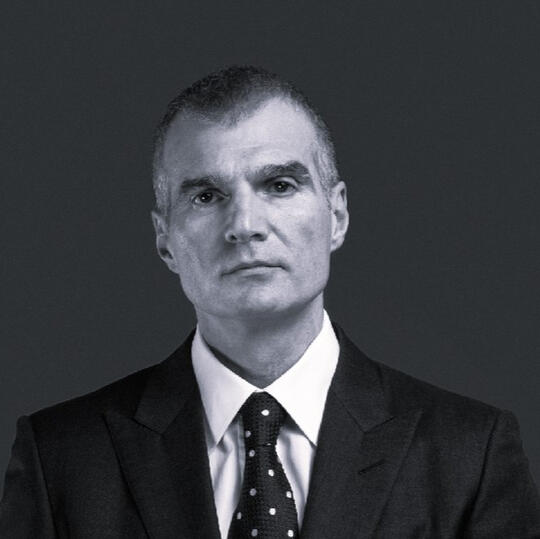

Andrej JovanovićAndrej is a successful entrepreneur and investor with over 30 years of experience.After co-founding and successfully exiting Marbo Product in 2008, Andrej served as CEO of Moji Brendovi, a leading collection of FMCG brands in the region, and participated in the successful consolidation of the Serbian banking sector through Direktna Banka and the subsequent Eurobank / Direktna joint venture.In addition, for the past 15 years Andrej executed several successful investments through a combination of public markets, real estate, and private equity type strategies, including through his investment in Blue Sea Capital.

Saša GalićSaša established Blue Sea Capital, a pioneering private equity fund in former Yugoslavia, in 2011. At Blue Sea Capital he oversaw the investment strategy of the Fund and chaired its investment committee, and actively took part in investment origination, negotiation, and execution.Prior to founding Blue Sea Capital, Saša was an executive director at UBS Investment Bank London. Before that he was member of the Management Board and Head of Strategy and M&A at Agrokor and a Principal Banker at EBRD.

Vuk VukovićVuk was most recently partner at Blue Sea Capital which he joined in 2011. There he worked on investment origination, execution, and monitoring and served as a member of the Investment Committee.Vuk’s prior experience includes working as equity analyst at Fidelity International in London and at KPMG in Serbia. Vuk is a CFA Charterholder, an ACCA and he holds an MBA degree from London Business School.

Mila ČičekMila spent over 10 years as a director in the Blue Sea Capital team, managing the Fund’s day to day operations, administration and audit as well as working on legal documentation, transaction structuring, execution, closing and monitoring.Before that, she was a director at Quaestus advisory as well as a director of structured finance at Agrokor.

Andrea GrozdanićAndrea has seven years of investment banking experience, most recently as part of J.P. Morgan’s Diversified Industries team in London. During his time there he advised on a number of transactions across M&A, debt, and equity products and spanning chemicals, automotive, capital goods, and business services sectors.Prior to J.P. Morgan Andrea was in the Industrials investment banking team at Nomura in London.

Katja JovanovićKatja graduated in Business Management from Pace University, with a focus on financial analysis and strategy.

News

Blue Sea Capital completes sale of MediGroup to Mehiläinen

December 19, 2025Blue Sea Capital, alongside MidEuropa, announces the successful completion of the sale of MediGroup, Serbia’s largest private healthcare provider, to Mehiläinen...

Read more

AJFH teams up with Bojan Radun to acquire regional dairy leader Imlek

November 20, 2025The family office of experienced entrepreneur and investor Andrej Jovanović, AJFH, acting as the lead investor, and Bojan Radun, a leading FMCG executive and Imlek’s current CEO, have entered into an agreement to jointly acquire Imlek, the market-leading dairy business...Read more

AJFH exits Optegra alongisde MidEuropa

May 30, 2025MidEuropa, a leading private equity investor with deep roots in Central Europe, today announced an agreement to sell Optegra, a leading European ophthalmology platform, to EssilorLuxottica...Read more

Blue Sea Capital announces sale of MediGroup to Mehiläinen

April 1, 2025Blue Sea Capital alongside MidEuropa today announces the sale of MediGroup, Serbia's largest private healthcare provider, to Mehiläinen, the largest private healthcare provider in Finland. The sale is part of a broader transaction...Read more

AJFH co-invests in FAMAR alongside MidEuropa

October 17, 2024Andrej Jovanović Family Holding (“AJFH”) announces its co-investment in FAMAR, a pharmaceutical contract development and manufacturing organisation (CDMO). In addition to AJFH...Read more

AJFH co-investing alongside Actis to acquire telecom tower portfolio in the Western Balkans

January 22, 2024Andrej Jovanović Family Holding (“AJFH”) is pleased to announce that it has agreed to co-invest alongside Actis in the acquisition of the macro tower portfolio of Telekom Srbija. A leading telecommunications operator...Read more

Blue Sea Capital completes sale of MediGroup to Mehiläinen

December 19, 2025Blue Sea Capital, alongside MidEuropa, announces the successful completion of the sale of MediGroup, Serbia’s largest private healthcare provider, to Mehiläinen, the leading private healthcare and social care provider in Finland.The transaction forms part of the broader acquisition of MidEuropa’s regional healthcare services platform, Regina Maria Group, and marks the completion of Blue Sea Capital’s long-term consolidation and growth journey with MediGroup in the Serbian private healthcare market.Blue Sea Capital was advised by Kinstellar and Van Campen Liem.

AJFH teams up with Bojan Radun to acquire regional dairy leader Imlek

November 20, 2025The family office of experienced entrepreneur and investor Andrej Jovanović, AJFH, acting as the lead investor, and Bojan Radun, a leading FMCG executive and Imlek’s current CEO, have entered into an agreement to jointly acquire Imlek, the market-leading dairy business in Serbia and the Western Balkans region, from private equity investor MidEuropa.Headquartered in Padinska Skela (Belgrade, Serbia) with state-of-the-art production facilities, Imlek purchases milk from more than 3,500 farmers and processes almost 400 million litres of milk annually across its four plants. With a diverse product portfolio and strong consumer brands including the iconic „Moja Kravica“ („My Little Cow“), Imlek is recognised as a cornerstone of the regional dairy industry and one of the most trusted household names in the region.AJFH and Bojan Radun, both with deep ties to Imlek and the broader regional FMCG industry, are joining forces to lead this regional champion into its next phase of growth. This is the first investment where AJFH acts as a lead investor and demonstrates the team’s capability to execute complex transactions.Andrej Jovanović brings extensive experience in the regional consumer goods sector. As the co-founder and former owner of Marbo Product, Serbia’s leading snack manufacturer later acquired by PepsiCo, and as CEO and co-owner of Moji Brendovi, a regional platform focused on branded food and beverage businesses including Bambi, Knjaz Miloš, and Imlek, Jovanović has a proven record of building and scaling regional market leaders.Bojan Radun, serving since 2018 as CEO of Imlek, has more than two decades of leadership experience in the FMCG sector, including as CEO of Bambi, the leading confectionery company in the Western Balkans, and Nectar, a leading regional juice producer where Mr Radun has a significant shareholding. Mr Radun also serves as chairman of Hortex, a prominent player in the frozen food and juice segment in Poland. Throughout his career, he has played a key role in transforming and expanding some of the region’s most recognisable consumer brands.Both Mr Jovanović and Mr Radun see significant potential in further strengthening Imlek’s position as the leading regional dairy producer through continued investment, operational excellence, and innovation.“Imlek is a remarkable company with deep roots, strong brands, and exceptional people,” said Bojan Radun, CEO of Imlek. “Together with Andrej Jovanović and the AJFH team, I am confident we can unlock even greater potential and reinforce Imlek’s role as the trusted dairy brand across the region.”The transaction is expected to close in Q1 2026, subject to customary regulatory approvals and closing conditions.The purchasers were advised by Kinstellar, EY Tax, and Van Campen Liem.

AJFH exits Optegra alongisde MidEuropa

May 30, 2025MidEuropa, a leading private equity investor with deep roots in Central Europe, today announced an agreement to sell Optegra, a leading European ophthalmology platform, to EssilorLuxottica, the global manufacturer and distributor of advanced vision care products, eyewear,

and med-tech solutions.Andrej Jovanović Family Holding co-invested alongside MidEuropa in February 2023.The Optegra group, under the Optegra, Lexum, and Iris brands, operates an extensive network of over 70 eye hospitals and diagnostic facilities across Europe, offering medically necessary ophthalmic treatments and elective vision correction procedures.The sale is subject to customary anti-trust clearance and is expected to close later this year.Partner press releases:

MidEuropa Announces Sale of Optegra to EssilorLuxottica

Blue Sea Capital announces sale of MediGroup to Mehiläinen

April 1, 2025Blue Sea Capital alongside MidEuropa today announces the sale of MediGroup, Serbia's largest private healthcare provider, to Mehiläinen, the largest private healthcare provider in Finland. The sale is part of a broader transaction encompassing MidEuropa’s regional healthcare services platform, Regina Maria Group. This transaction marks the culmination of the successful consolidation of the Serbian private healthcare market through MediGroup, which began in 2012 under Blue Sea Capital and continued under the joint ownership with MidEuropa’s platform.With over 1,700 full-time employees and around one and a half million patient visits annually, MediGroup is the leading player in private healthcare services in Serbia with well-invested facilities across key cities, providing inpatient, outpatient, lab, IVF, maternity, and ophthalmology services. The integrated healthcare platform was built through a series of acquisitions and greenfield investments, the highlights of which include the opening of a general hospital in Belgrade, as well as the establishment of an ever-expanding network of three special hospitals and 16 health centres and polyclinics. MediGroup serves its patients through the largest private ophthalmology hospital in Serbia and the largest private maternity hospital in Serbia, which has welcomed more than 6,000 babies to the world.Saša Galić, Managing Partner at Blue Sea Capital, commented: “We are excited that MediGroup is recognised as a natural fit for Mehiläinen, a best-in-class provider of healthcare and social care services in the Nordics region. The transaction validates Blue Sea Capital’s strategy of bringing local industries up to the highest standards.”Vuk Vuković, Partner at Blue Sea Capital, added: “We are incredibly proud of MediGroup’s journey to becoming Serbia’s leading private healthcare provider. This is an excellent case study in Blue Sea Capital’s value add, combining several family-led SMEs and transforming them into a well-integrated platform via professional management, consolidation, and a strategic investment programme. As a result, MediGroup now delivers strong benefits to the many local communities that it serves throughout Serbia.”Blue Sea Capital was advised by Kinstellar and Van Campen Liem.The transaction is subject to customary regulatory approvals and is expected to close in 2025.AJFH maintained a stake in MediGroup through its involvement in Blue Sea Capital.About Blue Sea Capital

Blue Sea Capital is an independent private equity company with offices in Belgrade and Zagreb, focused on small and medium enterprises in the region. Blue Sea Capital combines regional presence and the investment expertise of its team obtained in both international and local setting, and has so far invested in leading companies in its target sectors.About MidEuropa

MidEuropa is a leading European private equity investor with deep roots in Central Europe and a long-term track record in the region spanning over 25 years. Headquartered in London, with offices in Warsaw and Bucharest, MidEuropa adopts a flexible pan-European and global approach to identify winning investments across the healthcare, technology, services, and consumer sectors. MidEuropa works collaboratively with talented founders and management teams to support and facilitate sustainable growth through buy & build, organic growth acceleration, digital transformation, sustainability leadership and international expansion, to drive transformative growth and build industry champions. To date, MidEuropa has raised and managed funds of over €6.5 billion, and completed 46 investments and over 280 add-on acquisitions across 20 countries.About Mehiläinen

Mehiläinen Group is a well-known and highly respected private provider of social care and healthcare services, offering comprehensive high-quality services in its home market, Finland, as well as in Sweden, Germany, Lithuania, and Estonia. Mehiläinen offers digital healthcare software solutions through its subsidiary, BeeHealthy. 115-year-old Mehiläinen is a rapidly developing and growing leader in the industry. It serves 2.2 million customers annually, and services are provided at 890 locations by more than 37,000 employees and private practitioners. Mehiläinen invests in the possibilities of digitalisation and the effectiveness and quality of care in all its business areas. www.mehilainen.fiPartner press releases:

Blue Sea Capital announces sale of MediGroup to Mehiläinen

MidEuropa Announces Sale of Regina Maria Group to Mehiläinen

AJFH co-invests in FAMAR alongside MidEuropa

October 17, 2024Andrej Jovanović Family Holding (“AJFH”) announces its co-investment in FAMAR, a pharmaceutical contract development and manufacturing organisation (CDMO). In addition to AJFH, the current shareholders, ECM Partners and Metric Capital Partners, are reinvesting alongside MidEuropa and the Company’s management team.FAMAR is a trusted partner to a diversified blue-chip client base of pharmaceutical companies operating in more than 80 international markets. The Company provides a full-service offering across the CDMO value-chain, with broad capabilities across multiple dosage forms including sterile, solids, semi-solids, and R&D services. FAMAR employs c. 1,900 people working across a network of six manufacturing sites located across southern Europe with two complementary R&D centers.Partner press releases:

MidEuropa Acquires a Majority Stake in FAMAR

MidEuropa Completes Acquisition of Controlling Stake in FAMAR